alabama delinquent property tax phone number

Sales. Certified checks only after April 2nd.

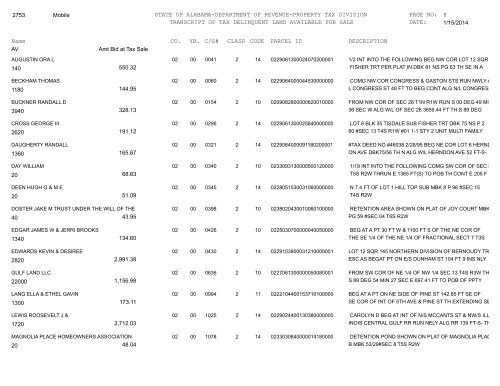

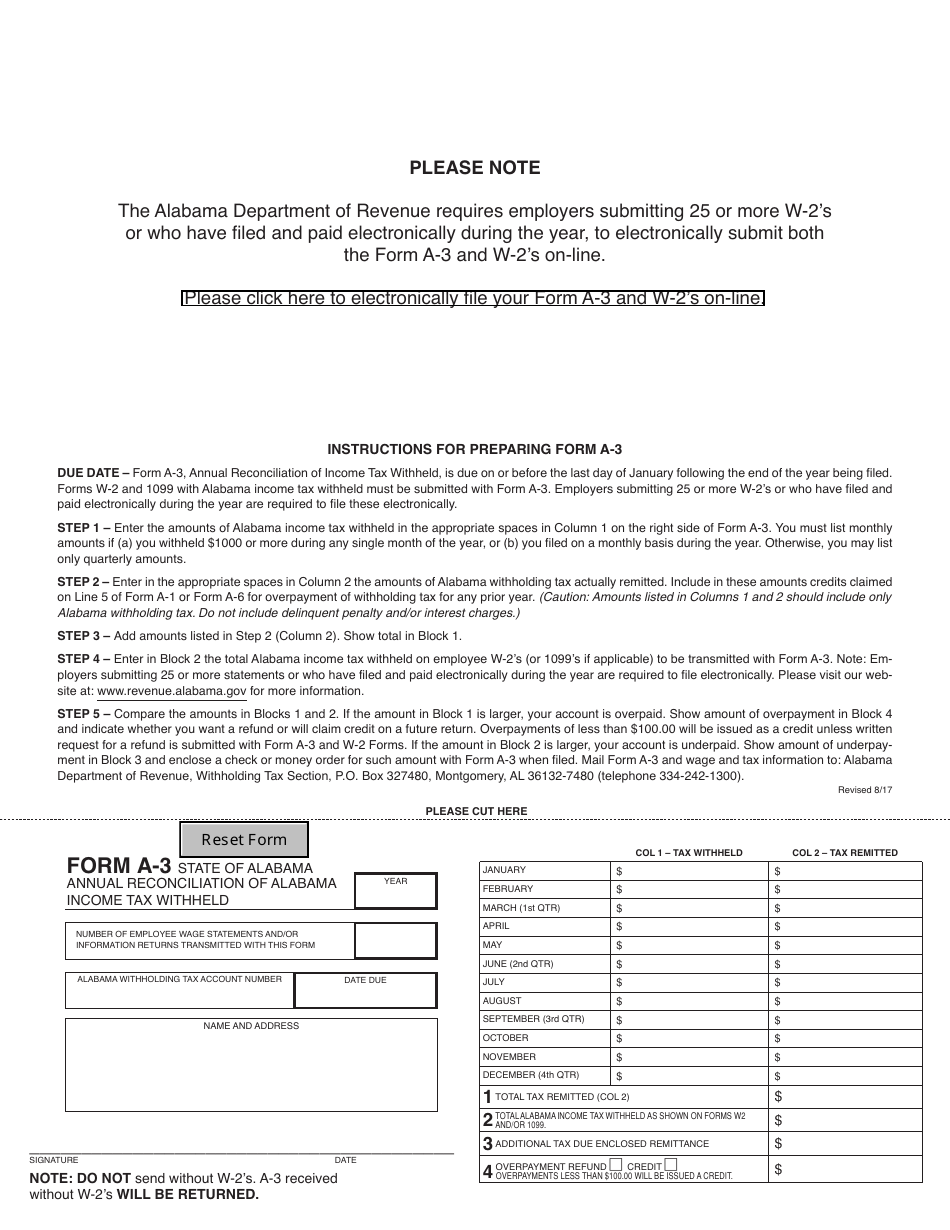

02state Of Alabama Department Of Revenue Property Tax Division

If you have documents to send you can fax them to the Elmore County assessors office at 334-567-1116.

. 220 2nd avenue east room 105 oneonta al 35121. You may come to the Collection Department located at the Calhoun County Administration Building and pay in person. To report a criminal tax violation please call 251 344-4737.

You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State. The process is very simple. You can call the Washington County Tax Assessors Office for assistance at 251-847-2915.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. Payment may be made as follows. Below is a listing by county of tax delinquent properties currently in State inventory.

If you have documents to send you can fax them to the Washington County assessors office at 251-847-3944. Once you have found a property for which you want to apply select the CS Number link to generate an online application. Once you have found a property for which you want to apply select the cs number link to generate an online application.

Property Tax Alabama Department Of Revenue. Please call the assessors office in Wetumpka before you send documents or if you need to schedule a meeting. Ask your county treasurer for the tax delinquent list.

January 1 - Taxes Delinquent. Always write your assessment number and account number on the check. Check back regularly - were loading county lists as they become available so stay tuned.

PUBLIC NOTICE TAX LIEN PUBLICATION. Select a county below to view the tax properties that will be available at auction this year. B You may pay by mail with check or money order to.

October 1 - December 31 - Property Taxes Due. 1702 Noble Street Ste 104. The median property tax in Houston County Alabama is 359 per year for a home worth the median value of 116300.

Search Mobile County property tax records by owner name address or parcel number and pay taxes online. Houston County collects on average 031 of a propertys assessed fair market value as property tax. Tax sale lists are updated daily to keep them fresh and to give you a head start on your auction research.

If you are a member of the media you may contact our Communications and Public Relations Section at taxpolicyrevenueAlabamagov or 334-242-1380. Registration for Business Accounts. Assessor Revenue Commissioner and Tax Sales Mobile County Revenue Commissioner 3925 Michael Blvd Mobile AL 36609 Phone.

Houston County has one of the lowest median property tax rates in the country with only two thousand six hundred fifty seven of. Accurate records must be kept at all times since this office is involved in the. Jeff Arnold Jackson County Revenue Commissioner PO.

The transcripts are updated weekly. In the online application enter. Property Tax Commissioner.

Dale County Revenue Commissioner Please continue to pay online and use the mail service when possible. Follow ShelbyCoAL_PTC SHELBY COUNTY ALABAMA. Receive the list in the method you choose email mail CD-ROM etc.

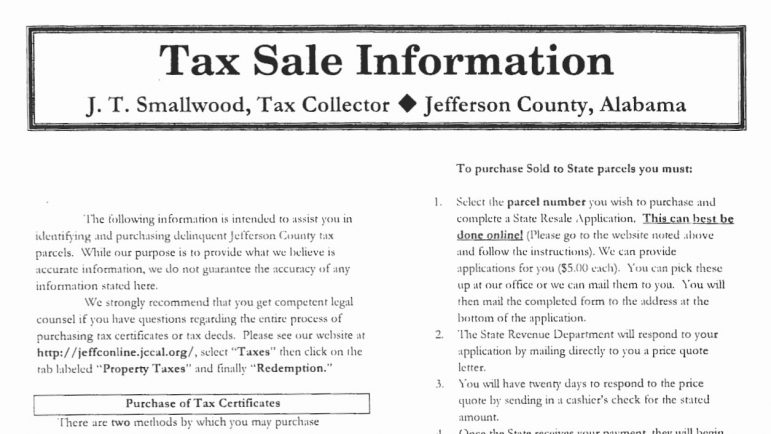

Failure to pay Property tax results in a Tax Lien Auction. March 1 - Delinquent Taxpayers will be notified of Tax Lien Sale date by first class mail. NOTICE OF DECLARATION OF THE JEFFERSON COUNTY TAX COLLECTORS OFFICE TO TRANSITION TO TAX LIEN AUCTION.

Payments on or after this date will be charged a late fee of 500 plus 12 annual interest. Determine the cost could be free or up to 500. Susan Jones Tuscaloosa County Tax Collector Tuscaloosa Alabama has been vested with the sole.

Transcripts of Delinquent Property. Tag Property Office including all satellite locations TAG. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

Property Tax sets the standards and procedures for equalization of property values in the counties and ensures property is taxed uniformly throughout the state. 334-242-1490 General Info or 1-866-576-6531 Paperless Filing Info Taxpayer Advocacy. All satellite locations are temporarily closed each year during November and December.

CITIZEN ACCESS PORTAL. Please call the assessors office in Chatom before you send. Tuscaloosa County Tax Collectors Announces Important Delinquent Property Tax Information.

Sales Use Tax. If you have any questions contact a Revenue Compliance Officer by calling 334 353-8096. A You may come to the Revenue Commissioners Office at the courthouse and make payment in person by cash check or money order.

To contact our office directly please call 205 325-5500 for the Birmingham Office or 205 481-4131 for the Bessemer Division. Taxes are due every october 1 and are delinquent after december 31st. Checks or money orders should be made payable to the Alabama Department of Revenue.

Property taxes are due October 1 and are delinquent after December 31 of each year. Calhoun County Revenue Commissioner. Our purpose is to supervise and control the valuation equalization assessment of property and.

Alabama Delinquent Property Tax Phone Number. The 2022 Alabama Auction season is in full swing. Ask your mortgage company to pay your bill.

View How to Read County Transcript Instructions. NOTICE OF SELECTION OF METHOD FOR COLLECTING DELINQUENT PROPERTY TAXES BY TUSCALOOSA COUNTY TAX COLLECTORS OFFICE. 307 Scottsboro Alabama 35768.

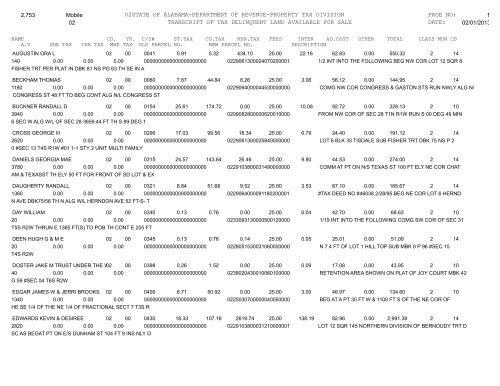

Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land. October 1- November 30 - Registered Mobile Home Decals are renewed without penalty. Mail a check to the treasurers office with a letter of instruction.

Alabama delinquent property tax phone number. When using a social security number mask the number using the following format. Taxes are due every october 1 and are delinquent after december 31st.

Section 40-10-180 of the Code of Alabama declares the tax collecting official for each county shall have the sole authority to decide whether his or her county shall utilize the sale of a tax lien for the sale of. Search Tax Delinquent Properties.

Faq Alabama Tax Sale Investing Youtube

Tax Notice Error Causes Homeowners To Fear Eviction Wbma

Tax Delinquent Land Sales In Alabama Wholesale Home Buyers Land For Sale Real Estate Buyers Property For Sale

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site

Property Tax Alabama Department Of Revenue

Marengo County Alabama 2017 Delinquent Property

02state Of Alabama Department Of Revenue Property Tax Division

Al Adv Ld 2 2011 2022 Fill Out Tax Template Online Us Legal Forms

Alabama Property Tax H R Block

Alabama Tax Relief Information Larson Tax Relief

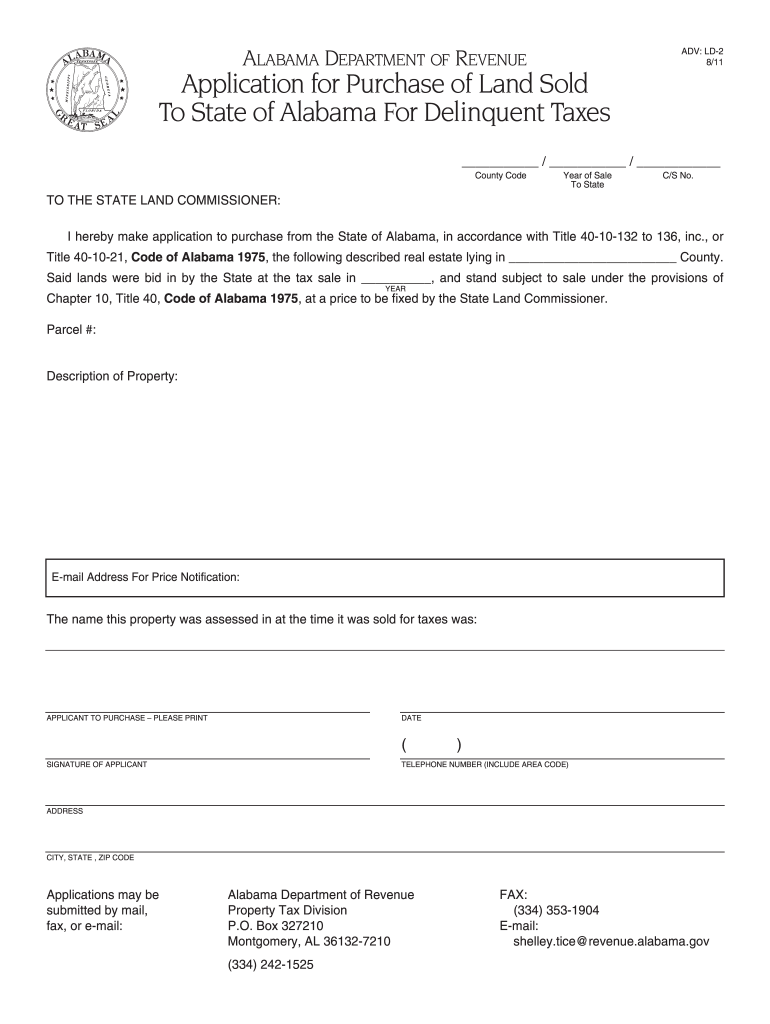

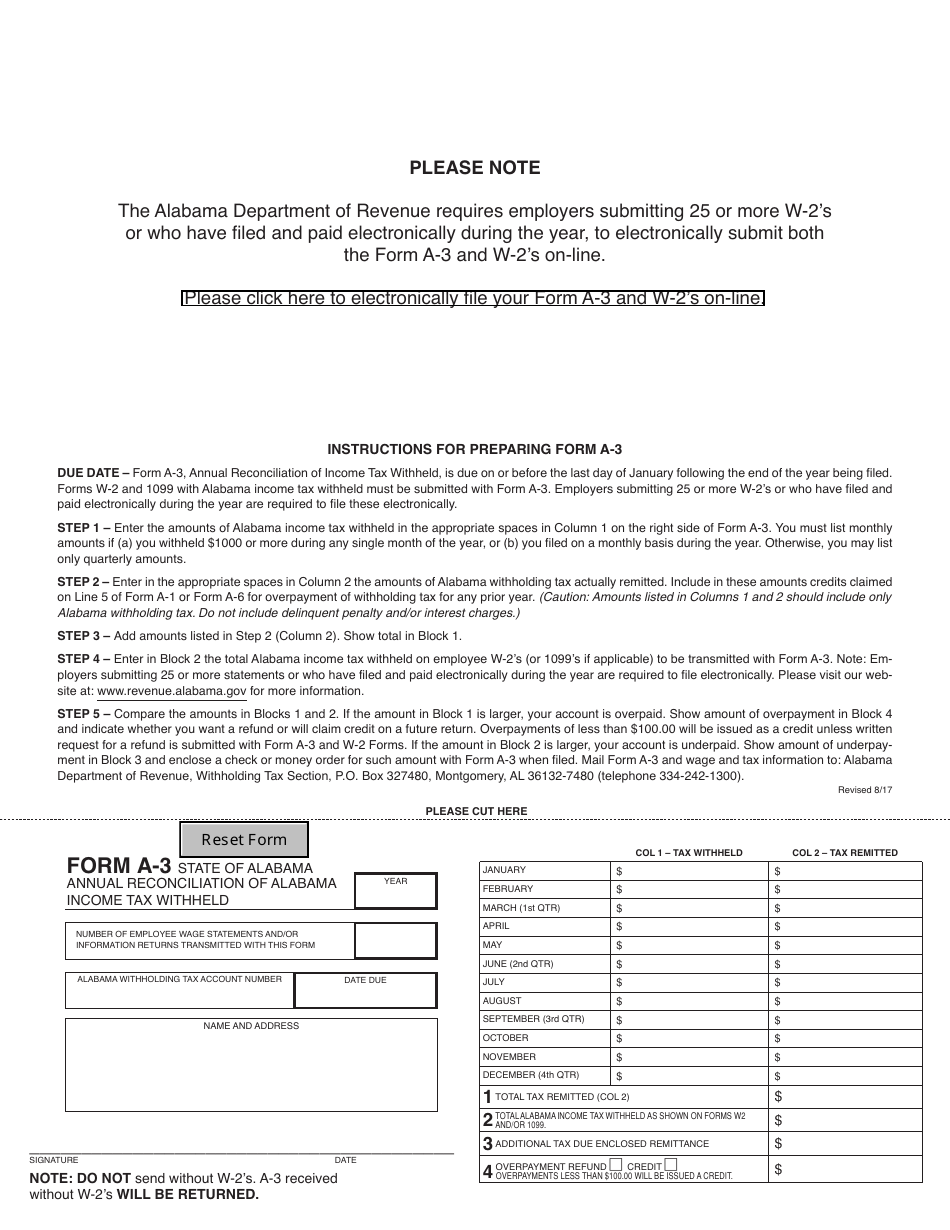

Form A 3 Download Fillable Pdf Or Fill Online Annual Reconciliation Of Alabama Income Tax Withheld Alabama Templateroller

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure